|

Here is a Generic Dimensional Model and SQL Views for Reports and Operational Data Models for

Private Banking,

Investment Banking

and

Retail Banking

and a combined Investment and Retail Model.

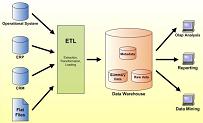

Here is a

a Pragmatic-style Dimensional Model

and a draft Data Ware Warehouse

before and

after a Facilitated Workshop to identify Business Requirements.

Here are some other relevant Data Models :-

Customers and Purchases Data Warehouse

e-Commerce Data Warehouse

Dimension Name Translation

Federated Data Marts

Investment Banking

Loading a Banking Data Warehouse

Here's an update on

Swiss Banking Requirements, dated October 2010.

These Requirements state, in part :-

"Big Swiss banks UBS and Credit Suisse must hold almost twice as much capital as set out in the new international Basel III standards.

Made up of top regulators, bank executives and other industry experts, the group said that the two banks would hold at least ten per cent of risk-weighted assets, based on new global standards (Basel III), in form of common equity.

In addition, the banks should hold another nine per cent, which could be contingent convertible (CoCo) bonds, taking the current total capital requirements to 19 per cent.

CoCo bonds in effect represent a type of insurance policy that shifts the burden of bailing out struggling banks away from the taxpayer and into the private sector.

The new Swiss rules go well beyond the Basel III regulations, agreed last month, which require banks to hold a minimum of seven percent in the form of common equity.

The two banks would have an end of 2018 deadline for the new global rules.

Barry Williams

Principal Consultant

Database Answers Ltd.

London, England

November 20th. 2010

|

© DataBase Answers Ltd. 2010

|